Your Journey To Financial Freedom and a Stress-Free Retirement Has Just Begun

TODAY ONLY $450

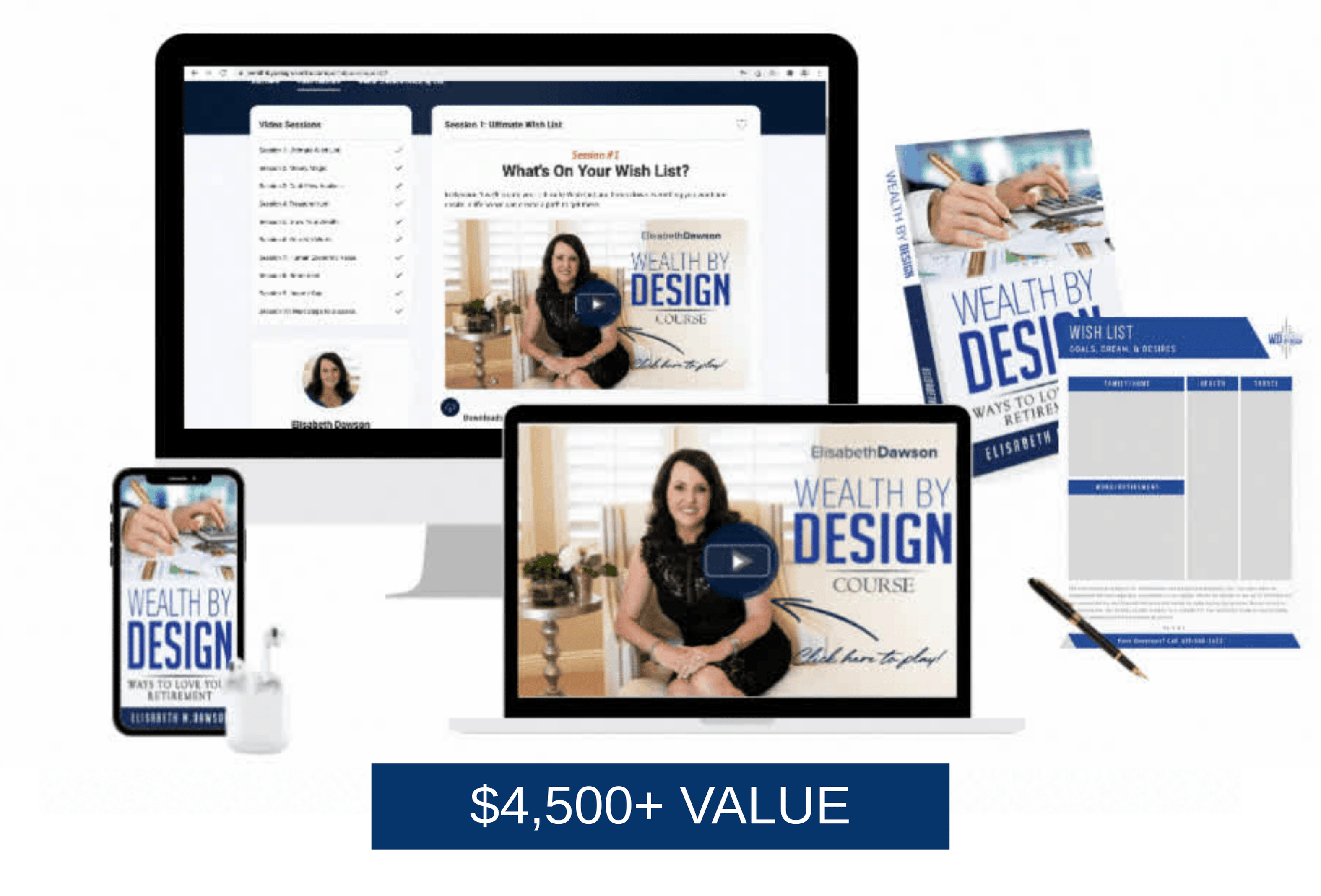

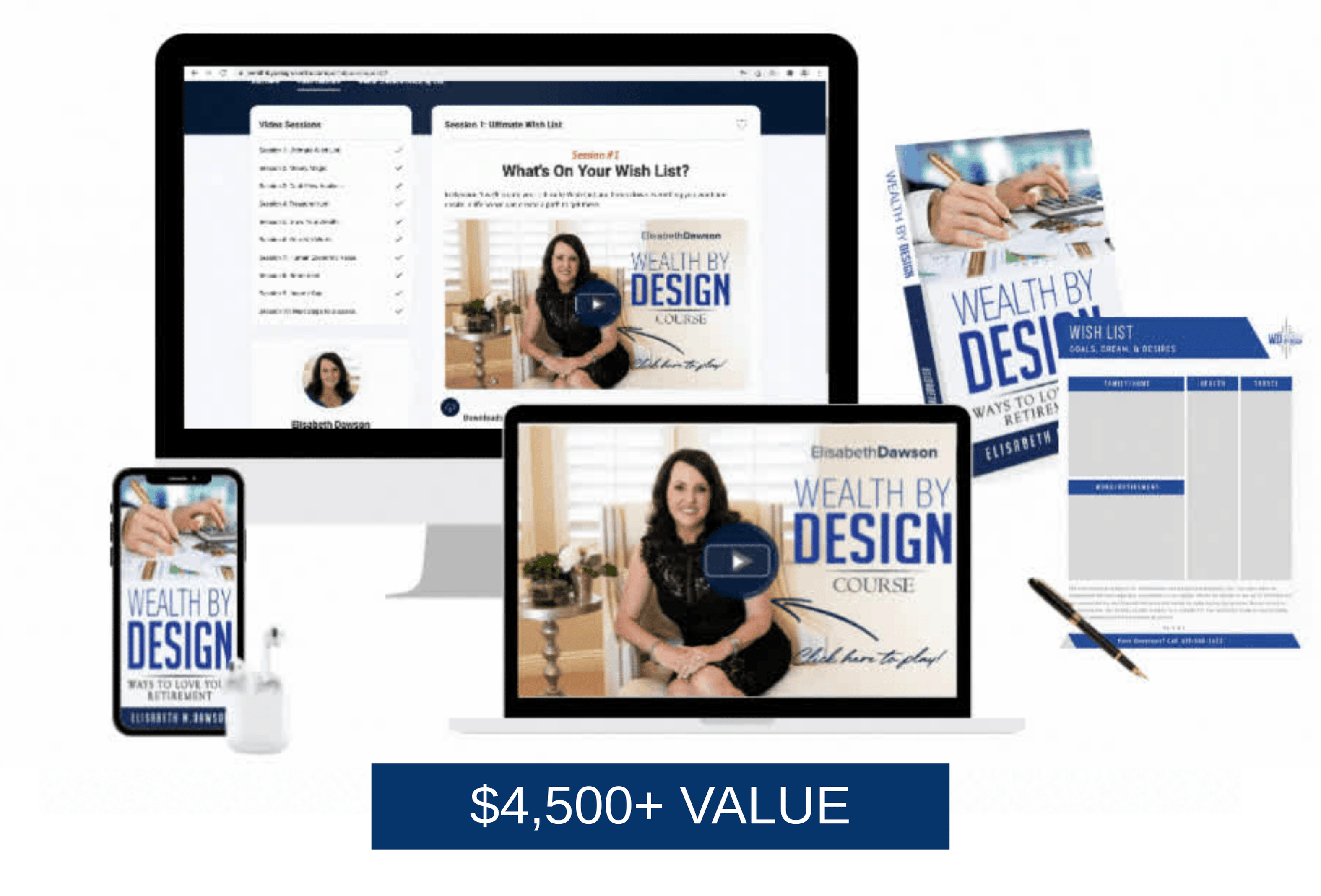

Total Value: $4500+

SAVE 90%

If you're like most people, you’ve been a prisoner to money your entire adult life, but that ball and chain is about to be permanently removed.

You’ve been worried and scared about your financial future, and you are moments away from having a blueprint for finding money and building wealth for yourself and your family.

Chances are that up until now you've been stuck in the same routine, and no matter what you do, you never seem to be able to get ahead.

Now you're going to be able to achieve the life and retirement that you dream of living.

You Have A Decision To Make That Is Going To Change The Entire Trajectory Of Your Retirement Income

And, I mean it.

There isn't a single aspect of your life that won't get better from the information contained in this course.

- Your anxiety levels will normalize and a sense of calm will wash over you.

- The stress in your shoulders, back and neck will melt away as a result of all this.

- There will be no more arguments over money and your relationship will begin to flourish.

- The dream you have will start to become a reality, and it’ll bring peace to your life and a sense of security to your future.

Yes, all of this is possible...

A life with peace of mind and financial freedom...

And you can achieve it!

But There Is Something Very Dangerous That Could Prevent Your Success

That thing is YOU!

You could sabotage yourself if, for whatever reason, you decide not to go through this course.

If you decide you’re too busy, you don’t have time, or you have better things to do.

Or if you decide not to put into practice what is shared, then all is lost.

All the things you dream of will continue to remain just a dream.

Unfortunately, this happens all too often.

In fact, statistics say this happens about 90% of the time.

Which means not taking this course, or taking it, but not acting on the information shared is a very real possibility for you.

A Threat to Your Financial Future

As it’s my mission to help as many people as possible in this world achieve greatness in their financial lives, I refuse to let that happen.

So let me tell you a story.

After selling thousands of copies of my book, I needed to find out what was still stopping people from taking the information and using it.

So, I sent out a survey and asked people what was holding them back.

When the results came back, I was shocked.

The vast majority of people said the exact same thing.

They read the book, and they had every intention of taking action, but when it came to implementing what they had learned, they just couldn't get started. They needed help figuring out how to put the knowledge into action.

They wanted to go deeper into everything that was covered.

They wanted worksheets and action plans that showed them exactly what to do and how to do it step-by-step.

It hit me like a lightning bolt.

Nobody wants to go at it all alone on their own.

That's Why I Created The Wealth By Design Online Financial Planning Course

As I poured through the chapters, I started creating everything that you need to extract what is shared and action it into your life.

What I ended up creating is a 10 part video course that walks you through step-by-step exactly what to do and how to do it.

It also comes with worksheets, spreadsheets and action plans that normally cost thousands to access and are reserved exclusively for my personal 1-1 clients.

Here’s Exactly What You’re Going to Get:

-

Session 1: What’s On Your Wish List?

In Session 1 we’ll create your Ultimate Wish List and break down everything you want and desire in life so we can create a path to get there.

-

Session 2: What are Your Core Money Belief’s? What is Your Relationship with Money?

In Session 2 we’ll dig into Money Magic and look at your Money Architype to really understand what is standing in your way from being able to achieve your Financial Dream Life

-

Session 3: Cash Flow Analysis

In Session 3 we’ll go through the Cash Flow Analysis so you can start to understand exactly where you are today and what it will take to reach your goals.

-

Session 4: What is a Lost Opportunity Cost?

In Session 4 (which is one of my favorites) we’re going to go on a little bit of a treasure hunt and i’ll show you all the easy money you can find without doing any extra work that can be deposited into your big bucket of wealth.

-

Session 5: The Wealth Recovery Account

Now that you have all this extra money, Session 5 will show you exactly what to do with it so you can start growing your wealth exponentially. This simple method is what is responsible for the success of nearly all my clients.

-

Session 6: Your Net Worth Statement

In Session 6 we’re going to calculate and take a look at your Net Worth so we can identify you financial health and confront the reality of where you are today.

-

Session 7: What is Your Human Life Value?

In Session 7 we’ll take a look at your Human Economic Value to determine your wealth of the future and get a clear picture on whether you can continue to live the life and raise your family the way you dreamed of if something were to happen to you.

-

Session 8: What Does Your Retirement Income Look Like?

In Session 8 we’ll tackle the topic of whether or not you’re going to have enough money to retire. Unfortunately, it’s usually more than you realize but once you know your numbers, then you can create a plan to get there.

-

Session 9: What is an Asset Gap Calculation?

And that’s exactly what we get into in Session 9 where we look at the Gap and determine exactly what is needed to get you to a financial free retirement.

-

Session 10: Final Questions to Ask Yourself…

Lastly, Session 10 brings everything together and lays out the next steps to success.

If you currently find yourself working tirelessly, day in and day out, without feeling you are making any real progress toward improving your financial picture and achieving your dream retirement, then you're going to want to pick up the The Wealth By Design companion course.

It will not only help you start to live your best financial life today, it’ll allow you to make substantial progress towards your ideal future.

There will never be a moment of confusion about what to do next because The Wealth By Design companion course walks you through everything.

This Is the Key to Your Success

So now the question is, what is that success worth to you?

What is your financial freedom and a stress-free retirement worth to you?

What is the ability to live life on your terms worth to you?

I can tell you what my personal clients pay, upwards of $20,000 a year.

If you paid half, that would be $10,000.

If you paid one quarter of it, that would be $5,000.

If you paid 10% of that, it would be $2,000.

But today I'm not going to ask you to invest even that.

When I thought more about my mission to help as many people as possible, I realized for some that might be too much.

So I chopped the price again.

That's right, just $450 for The Ultimate Wealth by Design Online Financial Planning Course.

There's a button below. That button is your key to your success.

That button is your key to breaking free from the shackles, permanently.

That's your key to financial freedom.

That's your key to a better life.

Here's What to Do Next

Click the button below and invest in your future.

You’ll get instant access and you can begin going through the course the second you log in to your members' area.

This isn't a hard decision.

This is going to make sure you actually get all the results.

Realize what it means.

Your freedom, your dream life.

Click the button now and I'll see you on the inside.

Total Value: $4,500+

SAVE 90%

TODAY ONLY $450

The information provided in this website is for informational and educational purposes only. This website is not investment advice nor is it intended to address the financial needs of any particular viewer. The opinions expressed of this website are not intended to be an endorsement of any particular investment strategy or service. You must make an independent decision regarding investments or strategies mentioned throughout the website. Before acting on information in this website, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from a financial or investment adviser.

Investment advice offered through Copia Wealth Management Advisors, Inc. Copia Wealth Management Advisors, Inc. is a registered investment adviser.

CA LIC #0C71264, #0G81294

Copyright 2026 © Elisabeth Dawson. All Rights Reserved.